To a Long and Healthy Retirement

Putting more life into your retirement plan

Happily ever after is only the beginning.

Retirement isn’t what it used to be. It’s longer. It’s more active. And it’s harder to predict.

Many of today’s retirees can expect to spend 30 years or more enjoying the fruits of their labor. That’s why it’s increasingly important not simply to plan for retirement, but to plan for longevity in retirement – all of the years it might last, all of the ways your life will change and all of the events you can’t foresee.

In addition to the financial implications – how best to save and how much – retirement has life implications:

- As you get older, changes in your health could mean less independence.

- Shifts in your abilities – and mobility – could impact access to things you enjoy.

- Your social circle likely will shrink.

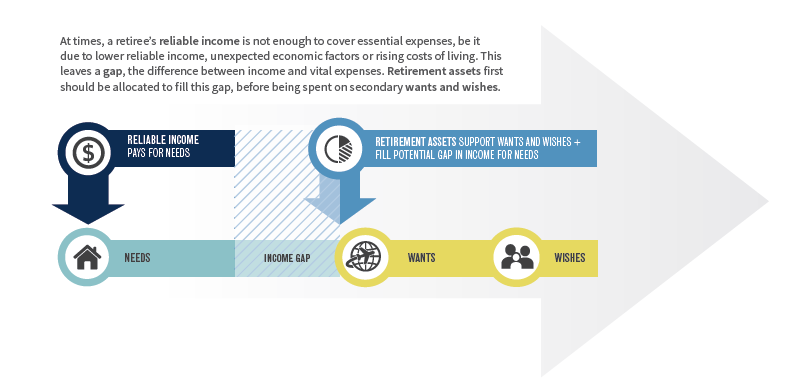

RETIREMENT GOALS CAN BE ORGANIZED INTO THREE CATEGORIES

- Your Needs – The essential expenses like your mortgage, insurance, taxes, food, clothing and healthcare.

- Your Wants – The extras you’ve worked hard for like travel, entertainment, club memberships and more.

- Your Wishes – The legacy you hope to leave for causes you care about and future generations of family.

Ask yourself this …

Beyond asking where you see yourself and even what your lifelong goals are, effective retirement and longevity planning begs some very big questions. Your financial advisor can serve as your center point, helping you consider every facet of a long and happy retirement – from healthcare and caregiving to transportation and housing.

KEY RETIREMENT QUESTIONS

WHERE WILL YOU LIVE?

Whether you’re bound for a dream home or planning to stay put, housing likely will be your biggest expense in retirement. While aging in the comfort of your own home would be ideal, modifications to the home – or your plan – could be necessary as mobility and transportation challenges arise.

Points to consider:

- Do you want to stay in your home? Will it need to be modified?

- What housing options are available to you, and what will they cost?

- Would you want to downsize? Relocate to a pedestrian-friendly neighborhood?

HOW WILL YOU GET AROUND?

It may come as a surprise, but transportation is the second largest expense for individuals older than 65 and accounts for about 15% of their annual expenditures, according to the Bureau of Labor Statistics. That’s why we make sure to account for it as part of your long-term financial plan.

Points to consider:

- How will you get to your favorite places in retirement?

- Who will assist you if you can’t drive yourself somewhere?

- What transportation options are available in your area?

87% of adults age 65+ want to stay in their current home and community as they age.*

* AARP PPI, “What is Livable? Community Preferences of Older Adults,” April 2014

HOW WILL YOU SAFEGUARD YOUR HEALTH?

Your health and your finances are intertwined in complex ways. Most expect Medicare to pay for their healthcare expenses in retirement. But, in reality, Medicare pays only 60% of healthcare costs* – you still will have premiums, copays and deductibles. As you age, healthcare costs can add up.

Points to consider:

- Do you have an existing condition? What will treatment cost over the long term?

- Do you know what costs Medicare will cover?

- How will you pay for what Medicare doesn’t?

- How will you make sure you receive the best care possible?

*Employee Benefit Research Institute, 2015

HOW WILL YOU SECURE YOUR LEGACY?

As you take the steps to plan for a comfortable retirement for as long as you may live it, it’s important to think even further. Ask yourself what kind of legacy you want to leave. How are you going to make sure you’re secure against financial fraud and work toward passing assets – and information – to your heirs to help secure your family’s future?

Points to consider:

- Have you spent significant time thinking about your legacy?

- Who will have access to your important documents and information when the time comes?

- How will you protect your assets and inheritors from financial fraud?

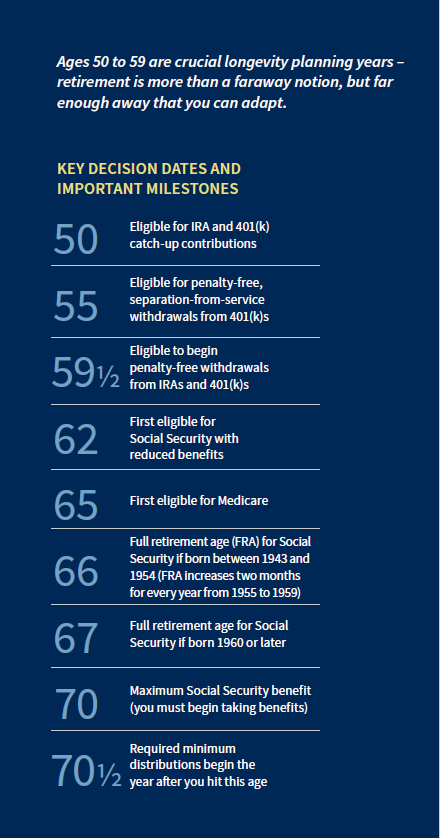

WILL YOU HAVE ENOUGH?

Giving yourself every opportunity to save enough for a long, fulfilling life requires careful, detailed longevity planning – strategies for saving, investing and taking withdrawals. Making the right Social Security claiming decisions is vital to optimizing your retirement income strategy.

Points to consider:

- When are you planning to retire?

- What sources of income will you have in retirement?

- How much income you will need in retirement?

WHO WILL TAKE CARE OF YOU?

As we all live longer, chances are you may, at some point, provide care for a loved one or receive care yourself. Becoming a caregiver can be not only stressful, but also can have financial consequences if it requires taking time away from work. And long-term care is not covered by Medicare.

Points to consider:

- Do you understand the full impact of being a caregiver?

- How will you get the care you need as you age?

- Should you consider long-term care insurance?

70% of Americans age 65 in 2014 will need some form of long-term care.*

* Department of Health and Human Services

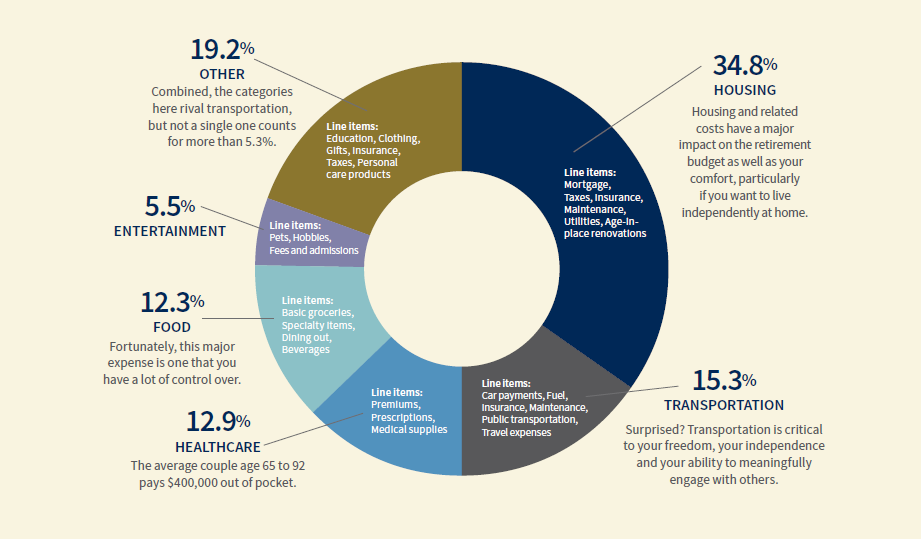

Where your retirement money goes

Wealth alone cannot buy a quality retirement any more than it can buy happiness – but having a solid financial foundation can make those years more enjoyable. As you consider a long, happy retirement, give some thought to the most expensive aspects – housing, transportation, healthcare and food – the effect of inflation and how to budget for it all. Entertainment should be included, too, since social activities enhance your physical and emotional well-being. Keep in mind that these percentages will vary as life changes, so it’s a good idea to account for the biggest line items as you plan for the future.

Source: Consumer Expenditure Survey (average annual expenditures for individuals 65+), U.S. Bureau of Labor Statistics, August 2016

Planning for a long, happy life

At Raymond James, we specialize in planning for a full financial life. We take a holistic approach to retirement planning – one that goes beyond investment account strategies to consider all of your needs, your wants and your wishes. Some of it will be exciting – dream homes, travel, time for family and hobbies. Some of it will be uncomfortable – the possibility of a health issue or need for long-term care. All of it will be on the table – and part of your comprehensive longevity plan.

PURPOSEFUL

Which savings plans are best suited to your situation? How could a little sacrifice now mean hitting a big goal later? What role will Social Security play? Your advisor is well-versed in all of your retirement options and the financial effects of each.

PERSONAL

Your advisor will get to know your situation and goals thoroughly, helping you explore your planning and investment options, explaining the merits of different approaches and helping to ensure that your plan is precisely calibrated for retirement as you envision it.

Talk to your Raymond James financial advisor, your specialist in planning for a long, fulfilling life.