Cash Reserve

What is a cash reserve?

A cash reserve is a pool of funds (and sometimes credit) that you hold in a readily available form to meet emergency and other highly urgent, short-term needs. Sometimes, it is referred to as an emergency or contingency fund.

Caution: Terminology is important here because contingencies often are not emergencies. Purchasing an expensive item that suddenly goes on sale or buying stock when its price suddenly drops might lead one to tap a so-called contingency fund, but these are certainly not emergencies.

The definition used here of a cash reserve is money set aside solely to cover critical, unexpected needs, such as a sudden loss of income. Consequently, it is not a fund for meeting anticipated expenses, large or small, such as real estate taxes, tuition, or a spontaneous vacation. Instead, a cash reserve protects you, your family, and your loved ones against unexpected financial crises.

Example(s): The manufacturer of a new computer you’ve been thinking about buying has just announced a substantial rebate on machines purchased within the next two months. While this might be an excellent opportunity to purchase the item at a reduced cost, it is not an emergency and therefore does not justify tapping your cash reserve. Maintaining sufficient savings elsewhere eliminates the temptation to tap emergency-designated funds for nonemergency needs.

Why is a cash reserve necessary?

A sound financial plan should ensure that you are protected when financial emergencies arise. In times of crisis, you do not want to shake pennies out of a piggy bank. Also, having a cash reserve may help prevent being forced to take on additional debt precisely when another financial challenge is the last thing you need. Consequently, the first step in the financial planning process should be to establish a cash reserve.

Determining how large a cash reserve should be

The amount of your cash reserve should be based on your own personal situation. While basic guidelines do exist, you should adjust them to reflect your unique circumstances. Some factors you should consider when determining a cash reserve goal include job security, the condition of your real estate, and the health of you and your dependents. Naturally, such factors change with time, so an annual review and adjustments are important elements of the planning process.

Three to six months of routine living expenses compose a typical cash reserve, but there are exceptions

You should generally follow the 3-6 months rule : that is, your cash reserve should equal 3 to 6 months of ordinary living expenses. Occasionally, low job security or high income volatility might suggest having a reserve of up to 12 months of expenses. The actual number of months selected should reflect these and other significant risk factors, such as the adequacy of insurance coverage and the condition of any property you own.

Using credit provides a higher-risk secondary funds source

Credit available to you can be a secondary source of funds in a time of crisis. However, because borrowed money must be paid back (often at very high interest rates), using lenders as the primary source of your cash reserve can create more long-term financial problems than it solves. Credit as part of a cash reserve functions best when it’s part of a multi-tier cash reserve structure that includes multiple financial resources.

Taking stock of what you have

List the locations and amounts of your money that you can withdraw on an immediate (or nearly immediate) basis without incurring a loss. Typical sources include savings accounts, money market accounts, Treasury securities, and cash value life insurance . Be careful to exclude accounts set up to meet everyday needs or special objectives, such as education, vacations, or a new car. You can also include untapped credit resources, provided you count them separately from cash resources.

Are you missing the goal? If so, by how much?

This is almost as easy as subtracting what you have from what you need. If you elect to consider credit resources part of your cash reserve, the procedure is slightly more complex, since part of the total amount must be held as cash (noncredit) assets.

Example(s): Hal and Jane determine that their cash reserve should equal five months of living expenses, or $25,000 ($5,000 per month). Because their current cash reserve is only $15,000 in a non-tax sheltered money market account, they need to save or reallocate an additional 10,000 to meet their goal. The $15,000 amount is sufficient to cover at least three months of expenses. Therefore, they can cover the $10,000 difference partly or entirely with available credit.

Achieving your cash reserve goal

Your initial thought is probably that cutting spending and saving aggressively are the only options for establishing or increasing a cash reserve . However, you may already have assets that you could make part of your cash reserve. These could include savings bonds coming due, the cash value of a life insurance policy you plan to convert, or even an antique you no longer care about that you might sell. The discussion that follows explains methods that you can use to build your reserve fund to the desired level rapidly.

Identifying, converting, and reallocating current assets to build your cash reserve

You may be able to reposition current assets . Current or liquid assets are those that are cash or convertible to cash within a year. You can designate those already in cash form to be part of your cash reserve. Those not in cash form can be converted to cash when appropriate and added to your cash reserve.

Examples of current assets include:

- Certificates of deposit and savings bonds that will mature in 12 months (avoid paying an early redemption penalty by waiting until they mature)

- An antique, a painting, or a piece of jewelry

- Stock shares

- A valuable collection (stamps, antique dolls, rare books, etc.)

- Current savings for nonemergency contingencies, part of which might be reallocated to your cash reserve

Evaluate the approaches to systematic saving currently available to you

If you have not established a cash reserve or if the one you have falls short of your goal, there are several paths you can take to eliminate the shortfall. Automatic savings (e.g., using payroll deduction at work) is one of the best approaches. Systematic savings that are budgeted as a regular household expense can also help. Curtailing discretionary spending is still another wise choice. Exploring the pros and cons of your alternatives will help you create a savings plan that is best for your own situation.

Develop a cash reserve savings plan to achieve your goal as rapidly as is reasonably possible

Having reviewed the available savings options, select one or a combination of approaches to achieve your cash reserve goal. Because an adequate cash reserve serves as your protection against financial chaos, you should be as aggressive as reasonably possible in achieving your goal. Combining both spending reduction and savings can help you quickly reach your goal.

Structuring and maintaining a cash reserve

The most important attribute of a cash reserve is its availability in time of sudden need. However, this does not necessarily require you to keep the entire sum in a low-interest savings account. There are several excellent alternatives, each with its own unique advantages. For those with a larger cash reserve, a multi-tier structure of sources based on timeliness of access is often desirable. Because income and personal circumstances are subject to change, periodic review of the cash reserve total and its structure is advisable.

Stash the cash: deciding where and in what form to keep a cash reserve

A federally insured savings account is considered one of the safest places to put money being reserved for emergencies, but when interest rates are in the basement, there may be better alternatives. Money market deposit accounts at a bank and various types of term deposits, such as certificates of deposit (CDs), typically offer higher interest rates with little, if any, increased risk. Term deposits are effectively a loan to the institution and not intended for withdrawal prior to the expiration or maturity date. Financial institutions generally assess a substantial penalty for early withdrawal. Laddering maturity dates provides a means of minimizing the impact of this disadvantage.

Money market mutual funds are another good choice. However, you need to understand that a money market mutual fund, whether from a bank or fund company, is not federally insured. With a money market fund, it’s possible to lose money, although most money market funds will go to great lengths to avoid “breaking the buck”–that is, allowing a share’s value to fall below $1, thus costing investors at least part of their principal. Be sure to obtain and read a fund’s prospectus (available from the fund) so you can carefully consider its investment objectives, risks, expenses, and fees before investing.

Caution: An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund

Ladder maturities of term deposits for better accessibility and lower interest rate risk

Laddering refers to staggering the maturity dates of fixed-term investment vehicles (i.e., those that pledge to return your principal plus interest on a given date). Certificates of deposit (CDs) and U.S. Treasury securities (T bills) are examples of savings vehicles you might consider as a second tier of your cash reserve. If so, spreading the maturity dates of such vehicles over a short time period (e.g., two to five months) assures their availability to meet sudden financial needs that may extend beyond a few months. Laddering enables you to seek a higher level of interest while preserving some accessibility and flexibility to adjust to changing financial circumstances.

Build a multi-tier cash reserve when using term deposits or credit lines

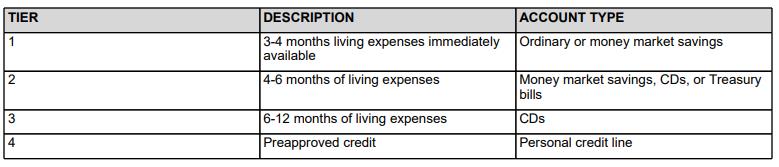

If your cash reserve includes more than two or three months of living expenses, you can consider dividing it into two or three tiers. You then have the option of using a different form of savings or credit for each tier. This method allows you to consider savings vehicles that offer higher interest rates, although such money will not be available immediately without penalty. If you choose to include credit as part of a multi-tier account structure for your cash reserve, always use it as the final tier, because payback requirements and related interest charges make it the least desirable form of emergency protection. The following table illustrates this point:

Review and adjust your cash reserve annually to reflect your changing circumstances

If anything is certain, it is that the personal and financial circumstances of you, your family, and your loved ones are very likely to change within the span of a year or two. A new child comes along, an aging parent becomes more dependent, a larger home or new car brings increased expenses, or maturing offspring leave the nest. Because your cash reserve is your first line of protection in a financial crisis, it is important to review it annually. If the amount and structure of your reserve no longer matches current needs, you should make the appropriate adjustments. An overly large reserve can mean that opportunities for better returns are being overlooked. In contrast, an undersized reserve increases the risk for financial chaos and stress in a time of sudden need.